Difference between finance lease and operating lease

Finance Lease - IAS 17

A finance lease substantially transfers all risks and events of the award to ownership of the property. The title may or may not be transferred.- Risks and rewards associated with ownership:

- Unrestricted right to use the property.

- Benefit from appreciation in property value.

- Damage due to accident or property not being properly handled.

- The property in the finance lease is found in the tenant's books, even though the property contained in the material is owned by the tenant in legal form (legal title).

Operating Lease (IAS-17)

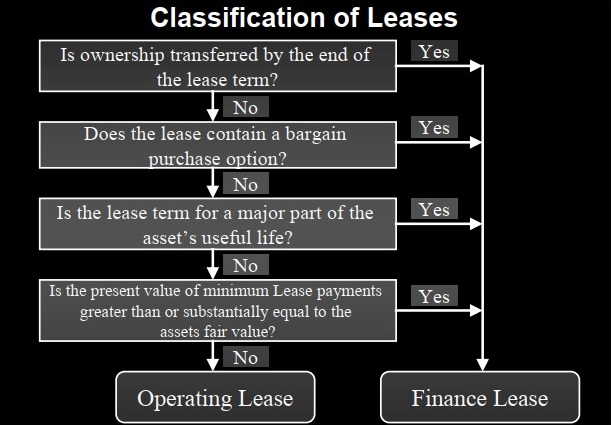

An operating lease is a lease other than a finance lease.Classification of lease (difference between finance lease and operating lease)

Examples of situations that can be classified individually or generally as leases are classified as finance leases:- Transfer of ownership of leased assets from owner to tenant.

- At the time of the establishment, the tenant has the option of purchasing the property at a price that is substantially lower than the fair market value at the time the establishment is exercisable. It is quite certain that the option will be used.

- The term of lease is a major part of the financial life of the property, even if the title is not transferred.

- The present value of the minimum lease payment amount for everyone at the beginning of the lease Fair value of rented property.

- The properties rented are of a certain nature so that only the tenant cannot use them at large changes.

0 Comments

Please do not enter any spam link in the comment box.